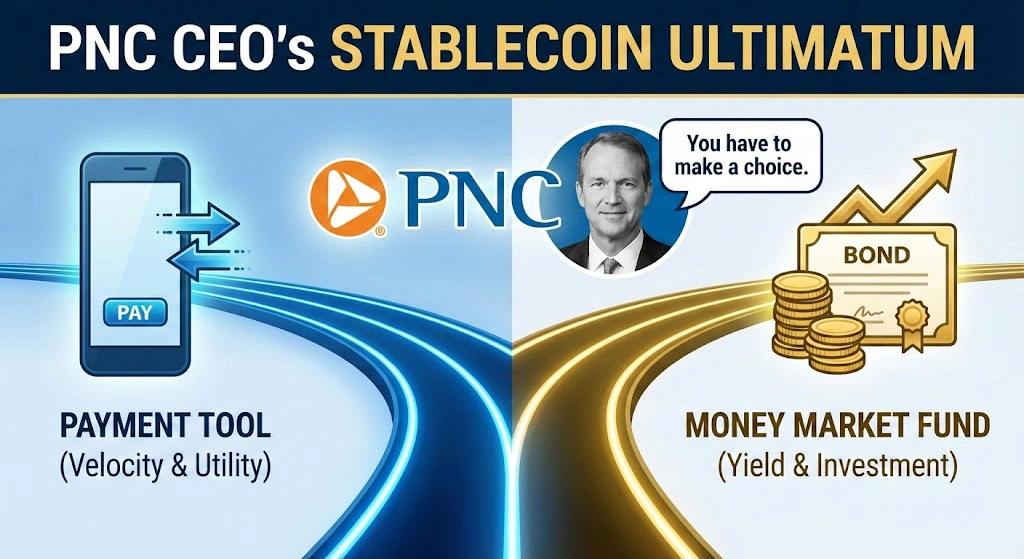

PNC Financial Services Group CEO Bill Demchak issued a direct challenge to the digital asset industry on Friday, asserting that stablecoins cannot effectively function as both payment instruments and investment vehicles.

Speaking during the bank’s Q4 2026 earnings call, Demchak argued that the current stablecoin model creates a dangerous ambiguity. He emphasized that issuers must decide if their products are designed for transactional velocity or yield generation, warning that trying to be both invites systemic risk.

The comments come as PNC deepens its integration with the digital asset economy. The bank recently operationalized its strategic partnership with Coinbase, leveraging the exchange’s “Crypto-as-a-Service” platform to offer digital asset solutions to institutional clients.

This infrastructure push aligns with the regulatory clarity provided by the GENIUS Act, passed in mid-2025, which established a federal framework for payment stablecoins. Demchak has long been a proponent of bringing stablecoins inside the regulatory perimeter, previously advocating for a consortium-led bank coin model to ensure compliance and stability.

PNC reported a strong finish to the fiscal year on Friday.

The bank confirmed the successful closing of its acquisition of FirstBank on January 5, a move Demchak stated would bolster their national presence.