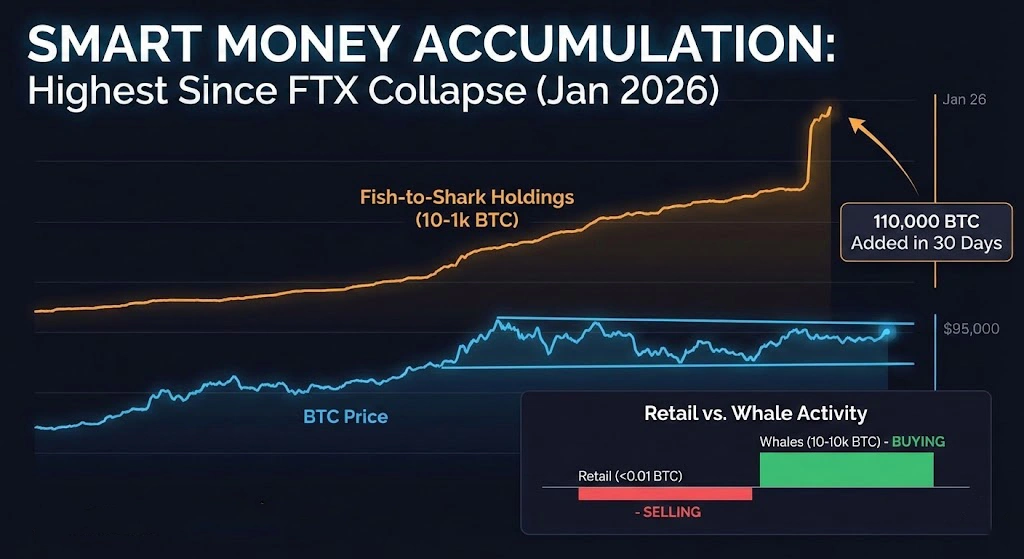

Amid lackluster price action in recent weeks, mid-to-large-sized Bitcoin (BTC) holders have aggressively accumulated coins at the fastest rate seen since the market bottomed following the FTX exchange collapse in November 2022.

According to data from blockchain analytics firm Glassnode, the “Fish-to-Shark” cohort entities holding between 10 and 1,000 BTC accumulated approximately 110,000 BTC over the last 30 days. This marks the most significant monthly balance increase for this group since Bitcoin traded near $16,000 over three years ago.

While Bitcoin consolidates around the $95,000 mark, a clear divergence has emerged between retail investors and “smart money.”

Market intelligence platform Santiment reports that while larger wallets (10-10,000 BTC) are buying, retail wallets (holding <0.01 BTC) are selling. Historically, this specific divergence signals a high probability of a price breakout, as coins move from “weak hands” to long-term holders.

This heavy accumulation suggests institutional confidence remains unshaken despite Bitcoin trading roughly 25% below its recent cycle highs. With over $10 billion worth of Bitcoin absorbed by these entities in just one month, the supply shock could serve as a catalyst for the next leg up.

This is not investment advice, it is for informational purposes only.