Ark Invest CEO Cathie Wood has reaffirmed her bullish stance on Bitcoin, urging asset allocators to view the cryptocurrency as a critical tool for portfolio diversification rather than just a speculative asset.

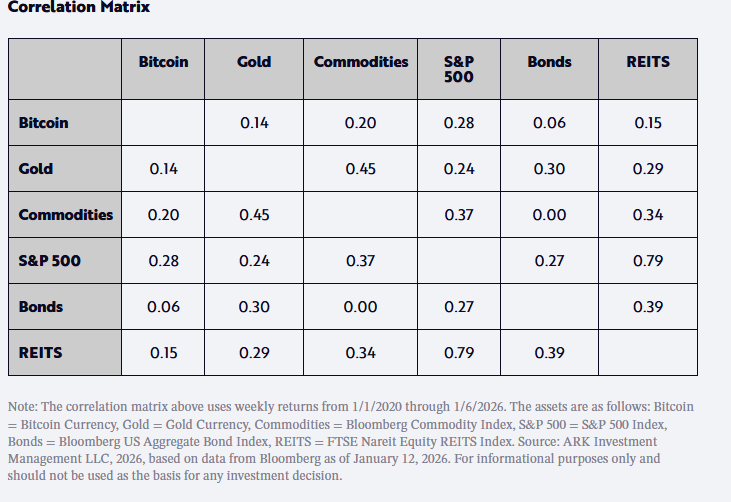

In Ark Invest’s 2026 Outlook released this week, Wood highlighted Bitcoin’s historically low correlation with traditional asset classes. According to Ark’s data, Bitcoin exhibited a correlation of just 0.14 with gold and 0.06 with bonds over the last five years.

“Bitcoin should be a good source of diversification for asset allocators looking for higher returns per unit of risk during the years ahead,” Wood wrote.

Ark’s analysis noted a striking divergence in 2025: while gold surged approximately 65%, Bitcoin slipped by 6%. Wood attributed the gold rally to global wealth creation outpacing the metal’s supply growth but argued that Bitcoin’s “mathematically metered” supply schedule growing at just ~0.82% annually makes it the superior long-term store of value.

“Gold miners, by boosting production, can do something not possible with Bitcoin.” – Cathie Wood, Ark Invest 2026 Outlook

The report suggests that despite recent volatility, institutional allocation remains the key driver for Bitcoin’s next leg up, with Ark maintaining its conviction that the asset could rival gold’s market cap in the coming decade.

Full report:https://www.ark-invest.com/articles/market-commentary/cathie-woods-2026-outlook