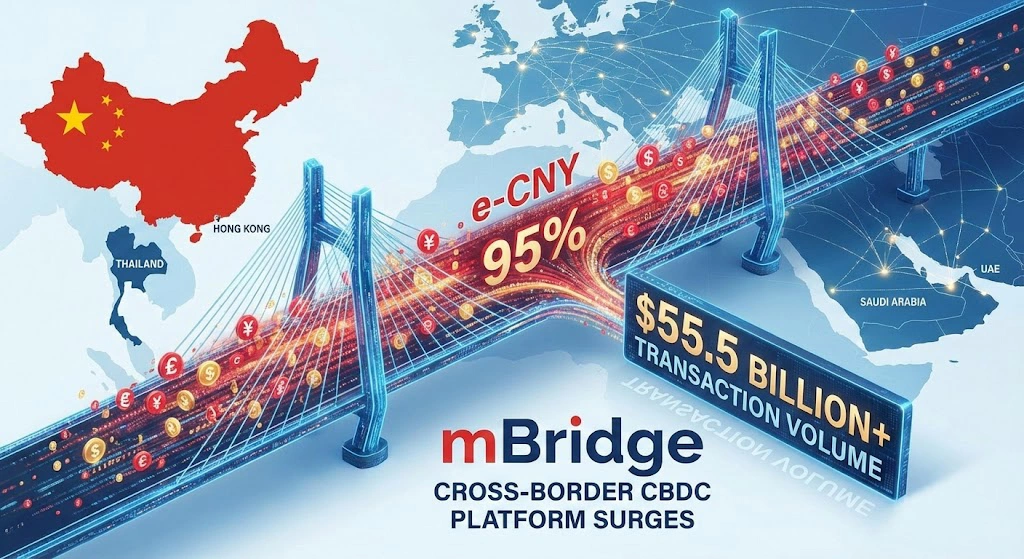

The China-backed mBridge cross-border central bank digital currency (CBDC) platform has processed over $55.5 billion in transactions, signaling accelerating momentum for alternative global payment rails.

According to data from the Atlantic Council cited by Reuters, the wholesale CBDC pilot has settled more than 4,000 cross-border trades. This represents a staggering 2,500-fold increase in value since the project’s early pilot phase in 2022.

e-CNY Dominance

The platform, which connects central banks in China, Hong Kong, Thailand, the UAE, and Saudi Arabia, is heavily driven by the digital yuan. The e-CNY accounts for approximately 95% of total settlement volume on the network.

This growth coincides with a massive expansion of China’s domestic digital currency infrastructure. The People’s Bank of China (PBOC) recently reported that the e-CNY has processed cumulatively 16.7 trillion yuan ($2.4 trillion) across 3.4 billion transactions an 800% jump from 2023.

Strategic Shift

The surge comes shortly after the Bank for International Settlements (BIS) officially transferred operations of mBridge to the participating central banks in late 2024. While the BIS has pivoted to the Western-focused “Project Agorá,” mBridge is rapidly cementing itself as a functioning alternative to the U.S. dollar-based correspondent banking system.

Analysts note that while mBridge doesn’t threaten the dollar’s dominance immediately, it provides a “parallel rail” for settling energy and commodity trades instantly without Western intermediaries.